Though our collective health is our highest concern, the economic damage brought by the Covid-19 lockdown is daunting, so we look for clues as to what our economic future might hold. One clue is the Depression of 1920, an often-overlooked crisis that began immediately after World War I and provides the most relevant and instructive comparison for our current situation.

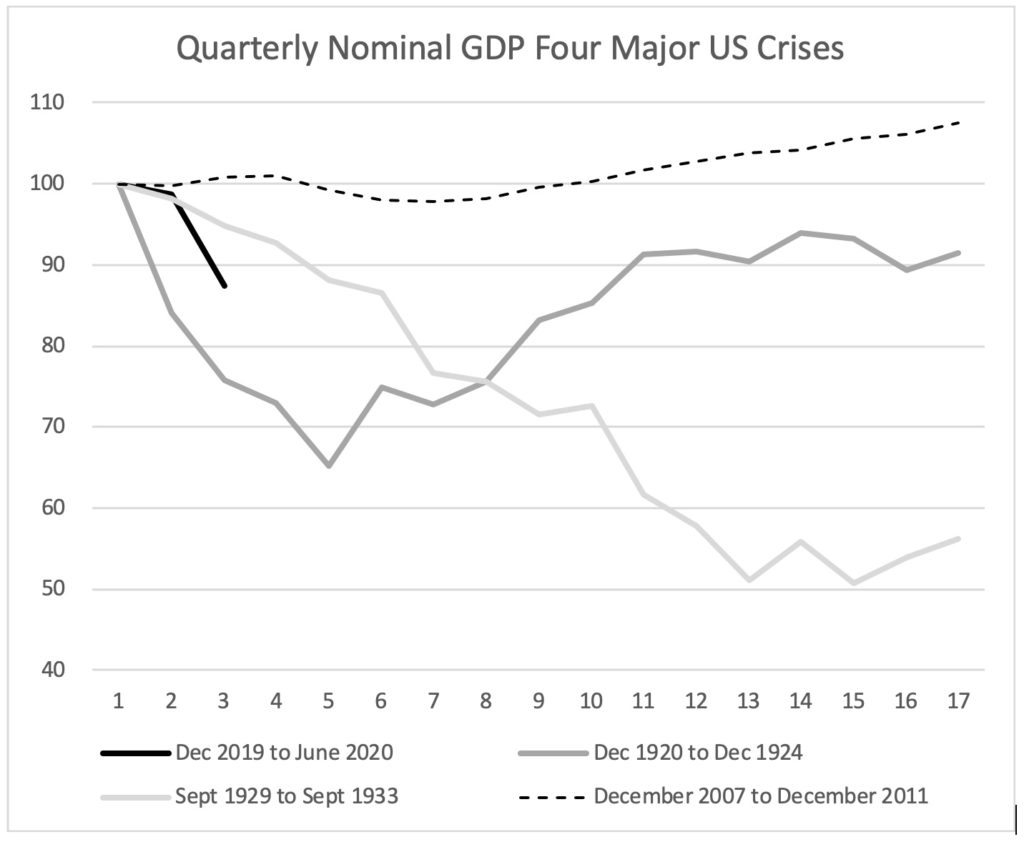

In our current crisis, we’re off to a terrible economic start. The chart below provides one perspective on this. It compares the quarterly trend of nominal GDP (gross domestic product, which is roughly the total spending in an economy) of our current crisis to three of the worst crises over the last 100 years— the Depression of 1920, our Great Recession of 2008, and the Great Depression of 1929. The charts below sets the quarter before the GDP drop for each of these equal to 100, and shows the trend from that point. The drop-off in our current crisis, which includes the CBO estimate for the June quarter, is almost as steep as 1920 and much steeper than in 1930 and 2008.

The Great Depression and the Great Recession came from massive overbuilding in real estate. In contrast, the current crisis comes from a sharp plunge in spending brought by forced closures and stay-at-home orders. Similar to our current crisis, the Depression of 1920 came from the sharp plunge in post-World War I military spending, coupled with the impact of the Spanish Influenza pandemic which brought death to 700,000 Americans.

So what was the Depression of 1920 like?

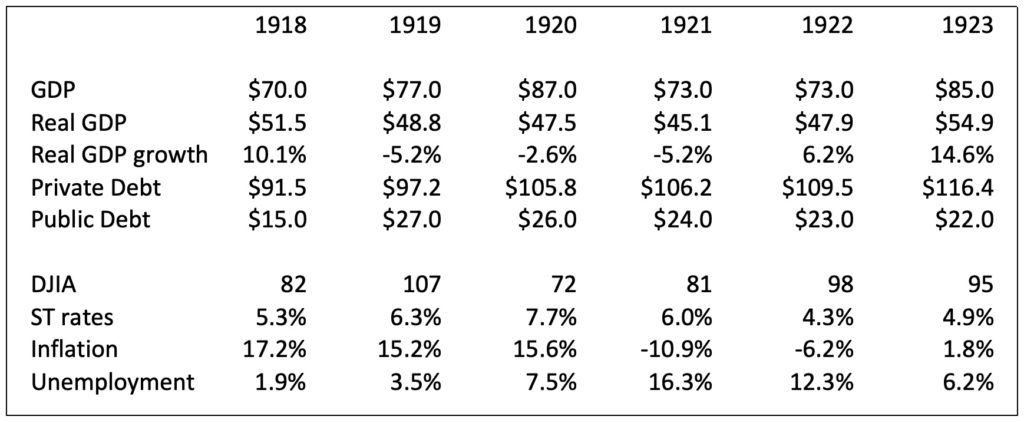

As the chart below shows, U.S. GDP contracted for three years, and it took a full five years for GDP to reach the level it had been in 1918. The stock market fell by a third, and had not climbed all the way back even five years later.

First, the Spanish Flu hit. It most likely started in rural Kansas and became a world-wide pandemic when soldiers from military camps in Kansas were shipped to the combat trenches of Europe, quickly infecting British, French, and German troops. In the U.S., deaths from the pandemic peaked in late 1918 and cities across the country responded by imposing quarantines and shut downs. The aftereffects lingered.

The war had been an economic boon, bringing unemployment down to 1.8% in 1918. But demobilized soldiers flooded the job market, with most having returned by the end of 1919, and unemployment surged to 16.3% by 1921. U.S. military spending and soldiers’ paychecks came to an end, and labor stress brought major strikes against U.S. Steel in 1919 and coal and railroad companies in 1921 and 1922.

The war caused the loss of a third of Europe’s farms, and America made huge shipments of its crops to Europe to stave off famine, causing grain prices to soar. That brought the rare combination of inflation and depression—inflation from food supply disruption and depression from the plunge in government spending. Inflation disappeared as European farms came back into production.

So why was America’s Depression of 1920 so long and painful? Because there was little if any government support. In fact, U.S. government debt levels actually contracted in this period—reflecting the decline in spending that exacerbated the pain. Most of America’s depressions to that point—which occurred in 1796, 1819, 1837, 1857, 1873, 1884, 1893, and 1907—had been long and painful, and for the very same reason. We hear the term “the long depression” to describe the 1870s and “the hung forties” to describe the aftermath of the 1837 crisis. In these depressions, government support was occasionally mentioned but never seriously considered. The U.S. government did increase spending in the 1930s in FDR’s famed New Deal, but the actual spending increase was minimal when compared to the amount of the spending collapse and had modest impact.

Yet U.S. politicians and economists learned from the Great Depression the importance of providing lending support through the central bank, and spending support through legislative action. These tools have been used increasingly by the U.S. and other major governments in crises in more recent decades, including the U.S. financial crises of 1987 and 2008, the Japanese financial crisis of the 1990s, and China’s financial crisis of 1999. Government actions in those crises helped inform our current response. In the early months of this crisis, the actions of the Federal Reserve have been decisive, broad, and deep, giving lending support to financial markets, and Congress has enacted significant early programs.

So the Covid crisis does not need to reach the three-year length of the Depression of 1920. But that outcome depends on sustained government support, including more current support for state and local governments and for households.

Without that, we could take another tumble.

One comment on “What do the Great Depression & Spanish Flu tell us about Covid-19 Recovery?”