There’s been great controversy about the Federal Reserve’s intervention in markets during and after the Global Financial Crisis, especially the so-called quantitative easing (QE) in which the Fed became a much more active buyer of Treasury Securities as a way of providing more liquidity and support to the banking system and the economy.

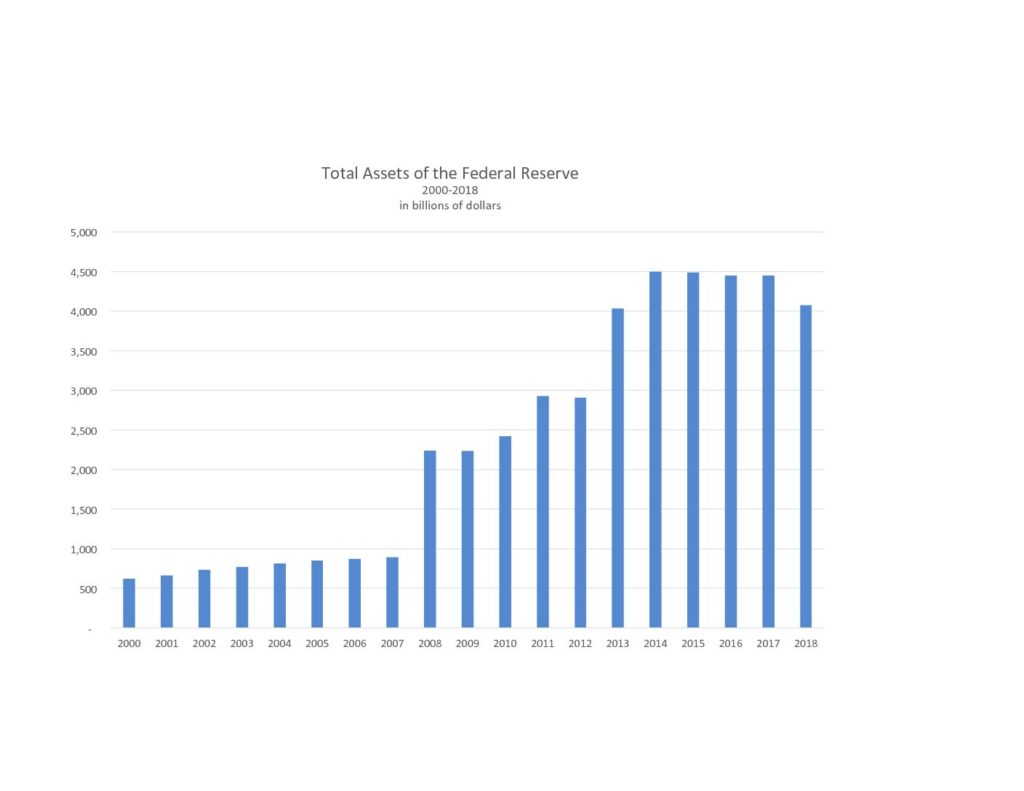

The numbers were eye-popping. The Fed’s total assets grew from $891 billion in 2007 to $2.2 trillion in 2008 as the Fed intervened to rescue the system. These assets took another dramatic step up from 2.9 trillion in 2012 to 4.5 trillion in 2014 as the Fed undertook its controversial QE initiative to try and boost the economy. They reached their peak of $4.6 trillion in January of 2015.

Economic doves applauded QE, while hawks cringed that the consequences would be dire—inflation, more asset bubbles, or worse. Since that time, there has been much debate and soul-searching about whether the Fed should continue or increase QE, or instead “unwind” QE by reducing the assets of the Fed to a size somewhat closer to its size before the crisis. Indeed, some are highly concerned that the Fed is too large and view it as an article of faith that the Fed needs to unwind QE.

Maintaining or increasing QE so that total assets remain high, or increase, would ease pressure on interest rates, keeping them low. Unwinding QE so as to decrease assets would create upward pressure on interest rates, with a slowing effect on economic growth—but would alleviate the concerns of these hawks regarding asset bubbles, inflation and other consequences.

Putting the Fed’s numbers in context helps provide an answer to this ugly debate. Even at the current level of $4.2 trillion, the Fed’s balance sheet is the smallest of the four large central banks, both on a relative and an absolute basis. The three others, the European Central Bank, the Bank of Japan, and the People’s Bank of China, are all over $5 trillion in assets on a dollar basis. And they all operate in smaller economies. The Fed is even smaller if viewed as a percent of US GDP. The Fed is 20% of US GDP, while the ECB is 40% of Eurozone GDP, the PBOC is 40% of China’s GDP, and the BOJ is a whopping 100% of Japan’s GDP.

In fact, even before the global crisis, the BOJ and the PBOC were larger relative to their respective economies than the Fed is now relative to the US economy.

There’s another way to put the Fed’s $4 trillion in perspective, and that’s to compare it to the size of the financial markets within the US, such as the money supply which is $15 trillion, the U.S. Treasury debt market which is $22 trillion, and the total public and private debt market which is almost $60 trillion. In fact, total financial assets in the US, including publicly traded equities, are $115 trillion.

This is all to say that in my view, at $4.2 trillion, the Fed’s total size is not excessive, and increasing or reducing the size of the Fed by a few hundred billion in either direction is manageable and tolerable.

A 25, 50 or even 100 basis point movement in interest rates up or down will affect economic trends at the margin, but it will not have a cataclysmic impact. With its ability to impact interest rates, the Fed is powerful, though not quite as powerful as people generally believe. The Fed follows more than lead the trends that ultimately determine interest rates. (The United States operated for over 80 years without a central bank.) Its one most important and crucial power is not interest rates, but instead the one that provided the original impetus to create a U.S. central bank in 1913 and which the Fed used to decisive effect in the Global Financial Crisis—its power as the lender of last resort.

As for interest rates—on balance, it’s probably appropriate to keep them somewhat lower. But low rates are far from a panacea, since they contribute to asset bubbles and exacerbate inequality.

And as to whether the Fed has to shrink? Viewed in the context of markets, history, and other central banks, it would appear that there is no imperative for the Fed to downsize. Instead, there may very well be benefit to the Fed staying at its current size. There may even be some room for the Fed to grow QE and still be relatively small compared to markets and to other central banks.

One comment on “Is the Fed Too Large?”