With all the (completely justified) focus on the coronavirus, we’ve overlooked Japan’s alarming GDP report.

Japan just reported a drop in GDP of 6.3% on an annualized basis for the December 2019. Japan’s GDP growth has been notoriously soft ever since its financial crisis of 1998. It reported its last drop in GDP a mere five quarter before, and on a nominal basis, GDP has barely budged upward in the 20+ years since the crisis. Forecasters are now pessimistic about results for Japan’s March quarter of 2020, especially given the impact of the coronavirus.

The proximate cause of the decline was the increase in sales tax (if government increases taxes, but doesn’t increase its own spending commensurately, GDP will decline by the amount of the tax increase), coupled with the damaging impact of Typhoon Hagibis in October.

But Japan’s underwhelming GDP growth isn’t just a function of current circumstances. It’s instead a function of the debt-loaded financial crisis and its debt-laden aftermath. The 1990s crisis in Japan came from a reckless run-up in private sector debt to GDP that reached an eye-popping 221%. The U.S. by comparison is a too-high 150 %, and was only 101% as recently as 1980. The Japanese private sector has been deleveraging ever since its crisis, which has been a huge drag on growth— since when individuals and businesses are deleveraging, it means they aren’t increasing the spending and investment that propels growth.

In the crisis aftermath, government debt growth has exploded, growing from a pre-crisis level of 70% of GDP to its current level of 238%. Japan now has a huge overhang of both private sector and public sector debt which has the fundamental consequence of making it harder to grow and is the fundamental underpinning of its economic struggles.

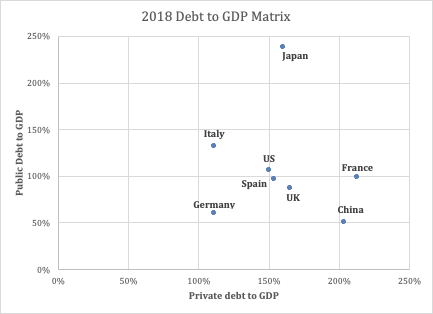

Look at Chart 1. Japan is the outlier among this group of large countries, with still-

high private sector debt and record-setting-high government debt.

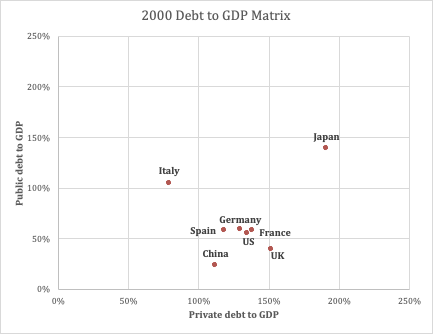

Now look at Chart 2 to see how much the world has changed in just one generation

(albeit the generation of the Global Financial Crisis).

In 2000, Japan was already an outlier, with debt levels that already hemmed in its options and stultified its economy, and its debt profile has only gotten worse. But notice how the rest of the world has since been catching up to Japan’s dismal profile.

Japan’s economic struggles are structural and will endure. A little Abenomics punctuated with an occasional ill-advised sales tax increase won’t change that.

And as we all know from our business and personal lives, the reason to avoid high levels of debt is that it makes us all the more vulnerable in a crisis. If the coronavirus defies efforts to control it, then Japan—along with a number of other nations—will get a stark reminder of that truth.