Today, my colleagues at the New America Foundation are having a half day forum titled “Recipes for Recovery: From Washington to Wall Street” at the Hyatt Regency on Capital Hill. It’s free, open to the public and starts at 10 am EST. For those who are not nearby, there will be youtube video capsules posted later.

Headliners are Medley Capital CEO Richard Medley, former Michigan Governor and National Association of Manufacturing President John Engler, Former Congressman William Frenzel, and others. They are well worth listening to — and those who can are invited to attend (I’ll be in Pittsburgh).

But with all due respect to my colleagues, two fundamental aspects of the “recovery picture” are missing from this august set of panelists. First is someone representing labor — even “main street” would be fine. But the link between Washington and Wall Street has been the problem. We need to see a recovery plan that links Washington’s thinking and policy parameters to main street.

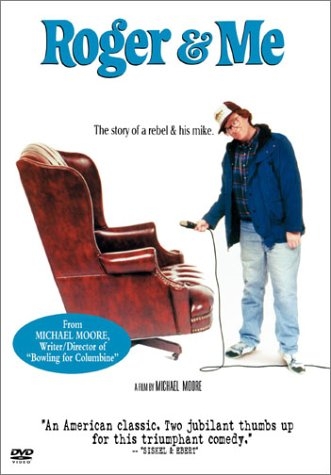

And now with the chatter all of a sudden about bailing out automakers, my favored speaker would be Michael Moore with a revival screening of Roger and Me.

More broadly, economic recovery in this country will not mean and can not mean putting everything back in place the way it was. Economic recovery cannot mean re-enabling the gluttony of manic consumption in this country without pumping up “production” and getting a more balanced portfolio between what we produce at home and ship in from others.

I would have incuded in this panel someone who could address the requirement of triggering new, much needed demand beyond American shores — particularly in Japan and China. America cannot see its economic picture improve without some fundamental changes in global economic patterns.

The subprime real estate problems were nationally-self inflicted and toxic financial products were injected intravenously by the U.S. into global financial flows — but the real weaknesses that this problem has triggered are far deeper and more profound. America has been overconsuming and underproducing for some time — and other global dollar holders have been feeding us cheap money to keep us binging. America became the principal driver of global growth — a single massive growth engine that employed people all around the world, while doing little to tend to job retention in the U.S.

And then the subprime crisis acted like a gravity switch — and behaviors now need to change.

We need a global remedy to growth that unleashes demand elsewhere as the U.S. gets its economic house back in order.

— Steve Clemons

18 comments on “Bailouts, Bubbles, Boils, and Trouble”